Spend $100 for free shipping!

Where Can We Ship?

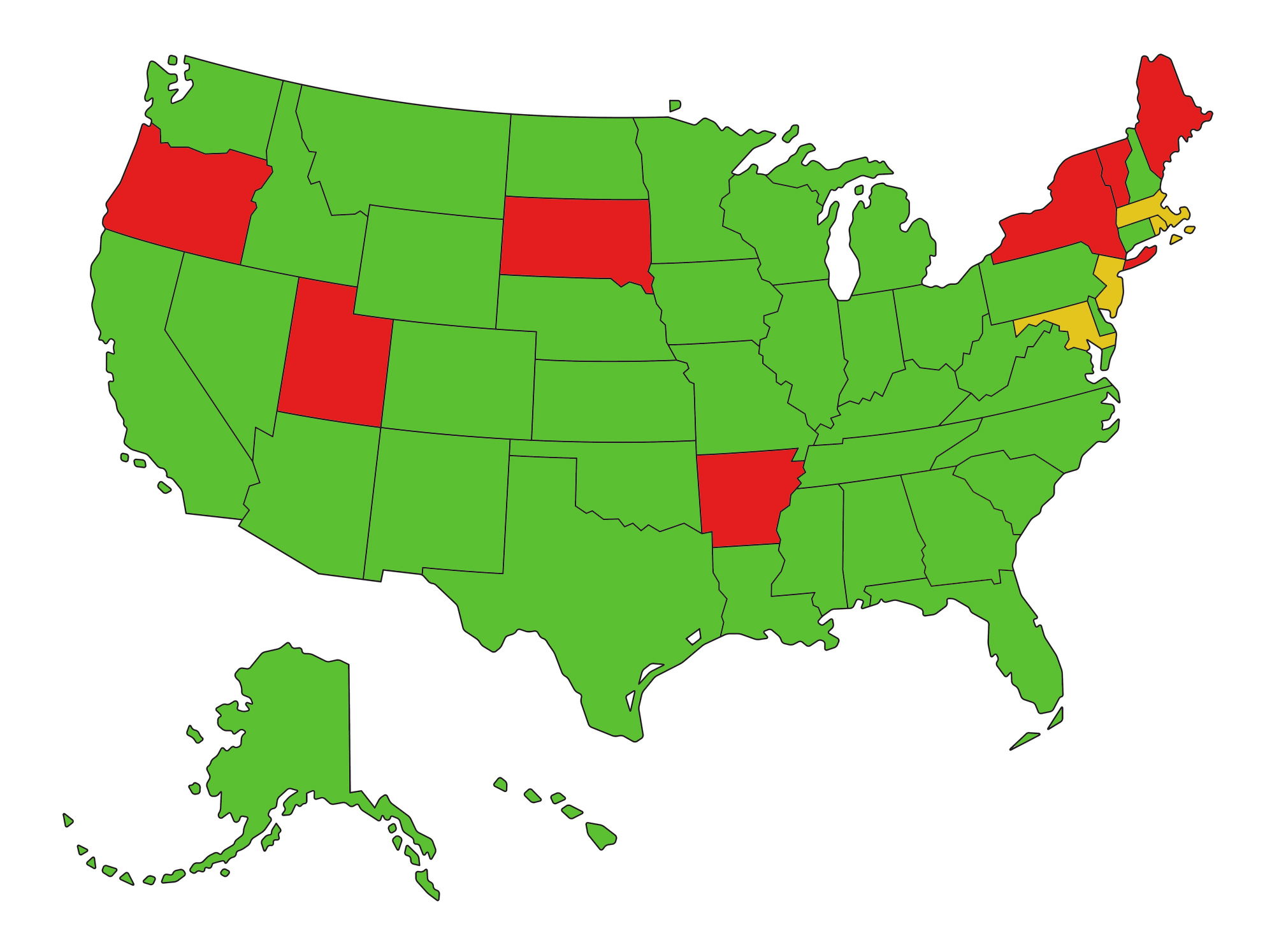

No Resrictions

Flavor Restrictions

Shipping Prohibited

Federal law requires 21+ Adult Signature at delivery.

We have partnered with PUDO to offer convenient pick-up locations at a local business near you. Simply select the "PUDO pickup" shipping option during checkout and select your preferred location.

If you live in a city or state where shipping is restricted we will automatically present the nearest pick-up locations where shipping is allowed!

If you live in a city or state where shipping is restricted we will automatically present the nearest pick-up locations where shipping is allowed!

We cannot ship to PO Boxes, military bases, US territories, or countries outside of the United States.

We are unable to ship any products to the following states: Arkansas, Maine, New York, Oregon, South Dakota, Utah, Vermont

We are unable to ship any products to the following regions: Anchorage (AK), Chicago (IL), San Francisco (CA)

We are unable to ship any flavors besides tobacco to the following states: Massachusetts, New Jersey, Rhode Island

We are unable to ship any flavored disposables to: Maryland